Now Reading: UPI May Soon Enable Transactions From 192 Countries

-

01

UPI May Soon Enable Transactions From 192 Countries

UPI May Soon Enable Transactions From 192 Countries

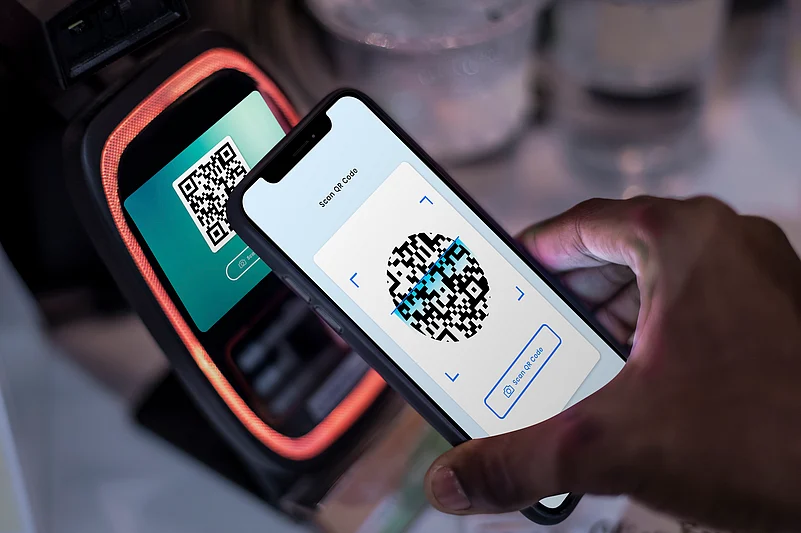

India’s Unified Payments Interface (UPI) could soon expand its reach to allow transactions from as many as 192 countries, a move that would significantly boost cross-border payments and strengthen India’s position in the global fintech space. The project, being developed in coordination with international partners, aims to make digital transfers faster, cheaper, and more accessible for people living and working abroad.

For millions of Indians residing in countries like the UAE, US, UK, Canada, and Australia, this development could transform the way they send money home. Instead of relying on expensive remittance channels, UPI’s entry into global transactions promises instant transfers directly to bank accounts in India. Tier-2 and Tier-3 cities, where families often depend on overseas remittances, stand to gain the most from this step.

The expansion also reflects India’s growing influence in the digital payments ecosystem. UPI has already become the backbone of domestic digital transactions, with billions of payments processed every month. Extending the system globally could make it a trusted model for cross-border payments, offering an alternative to traditional systems that are often slow and costly.

However, experts point out that the rollout will depend on regulatory approvals, data security standards, and interoperability with banking systems in partner countries. Ensuring compliance with global anti-money laundering norms and addressing cybersecurity risks will be crucial before UPI transactions can be fully operational across borders.

If implemented smoothly, this move could reshape the remittance landscape for India, making financial services more inclusive and efficient. For households in smaller towns that rely on foreign income, UPI’s global reach could provide faster relief and better financial security. The expansion would mark another step in India’s push to set new benchmarks in digital innovation.