Now Reading: How Scam Emails Look More Real Than Ever

-

01

How Scam Emails Look More Real Than Ever

How Scam Emails Look More Real Than Ever

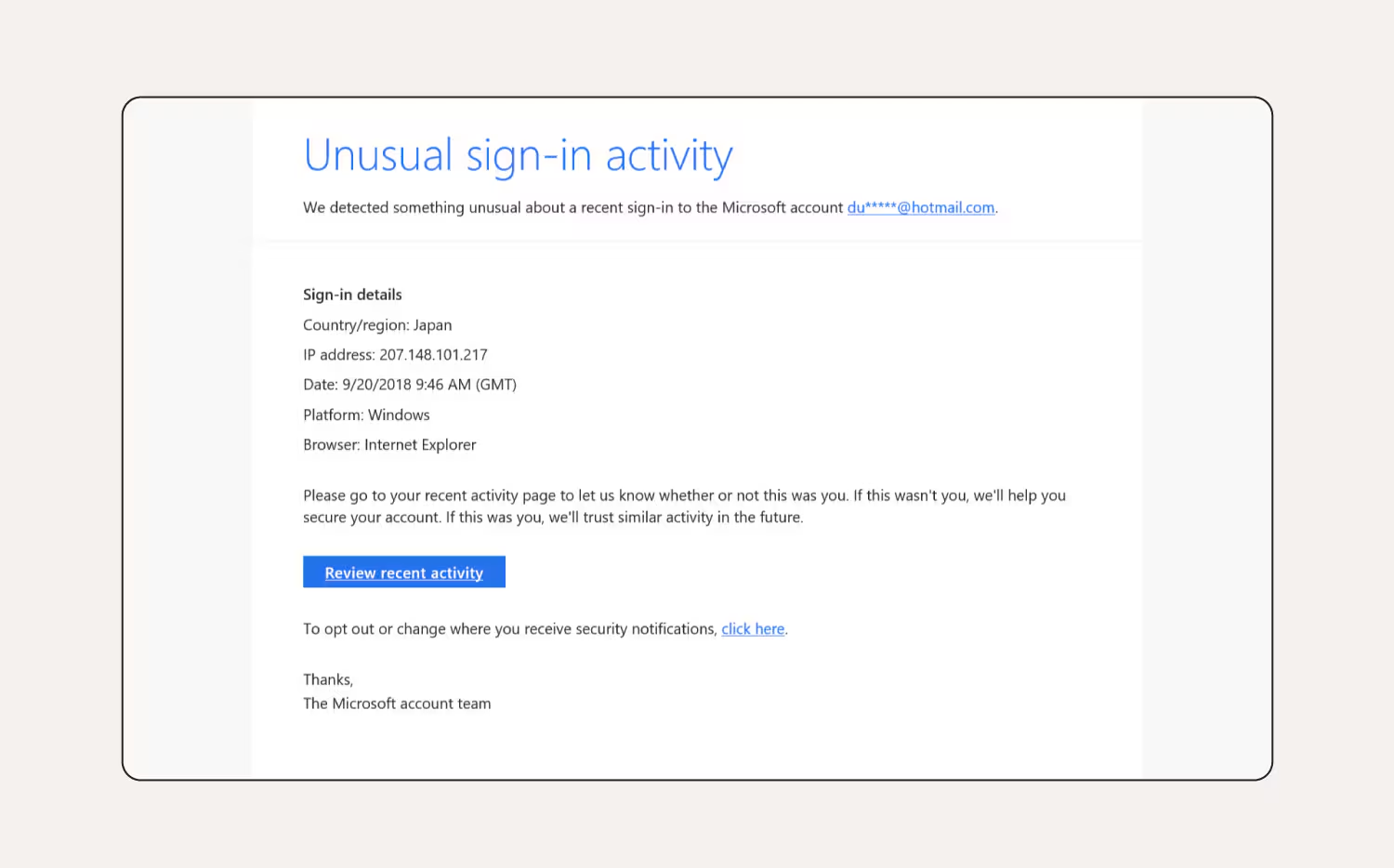

Not long ago, scam emails were easy to spot—full of spelling mistakes, strange fonts, and suspicious links. Today, they’ve evolved. Scammers now craft emails that look identical to those from trusted banks, delivery companies, or even government portals. With logos, sender addresses, and tone matching official communication, it’s becoming harder for people to tell what’s real and what’s fake.

These emails often play on urgency. They might say your account is locked, a parcel is waiting, or your KYC needs updating. The message pushes you to click a link or share personal details instantly. Once you do, you’re directed to a fake website designed to steal passwords, card details, or OTPs. What makes them dangerous is not just how real they look, but how personal they feel.

In India’s Tier 2 cities, where digital banking and online payments are rapidly growing, many users are new to identifying such threats. Scammers take advantage of that learning gap. They use advanced tools like AI-generated text and cloned templates from real companies to make their traps believable. Even professionals have fallen for such emails because the designs and tones are nearly flawless.

What this really means is that visual trust can no longer be your only guard. Always check the sender’s full email ID—scammers often replace one letter in the domain to mimic official ones. Avoid clicking on links directly from emails; instead, visit the official website manually. And remember, no bank or service ever asks for sensitive details through mail.

The truth is, scam emails now pass every visual test, but they still fail the logic test. If an email pressures you to act fast or threatens consequences, stop and think. A few seconds of doubt can save you from days of regret.