Now Reading: Eight overnight shifts shaping India’s stock market today: From US Fed’s rate cut to Nvidia’s surge

-

01

Eight overnight shifts shaping India’s stock market today: From US Fed’s rate cut to Nvidia’s surge

Eight overnight shifts shaping India’s stock market today: From US Fed’s rate cut to Nvidia’s surge

The Indian stock market opened today against a backdrop of major global developments that could influence trading sentiment. From the US Federal Reserve’s rate cut to movements in technology stocks like Nvidia and changes in crude oil prices, investors are recalibrating their strategies. Here’s a breakdown of the eight key factors that changed overnight and what they mean for Indian markets, especially for retail traders across smaller cities.

1. US Federal Reserve rate cut

The Fed’s decision to trim interest rates has sparked optimism across global markets. Lower rates generally support liquidity and can draw investors towards emerging economies like India. It also suggests a shift in the US stance toward supporting growth amid inflation moderation.

2. Gift Nifty’s early cues

Gift Nifty trends indicated a slightly positive opening for Indian indices. The data reflects cautious optimism, with traders watching for signs of follow-through buying after recent volatility in mid- and small-cap stocks.

3. Global market sentiment

Asian markets opened mixed, following cues from Wall Street where investors reacted positively to the Fed’s move. However, concerns about slowing global growth continue to keep market enthusiasm in check.

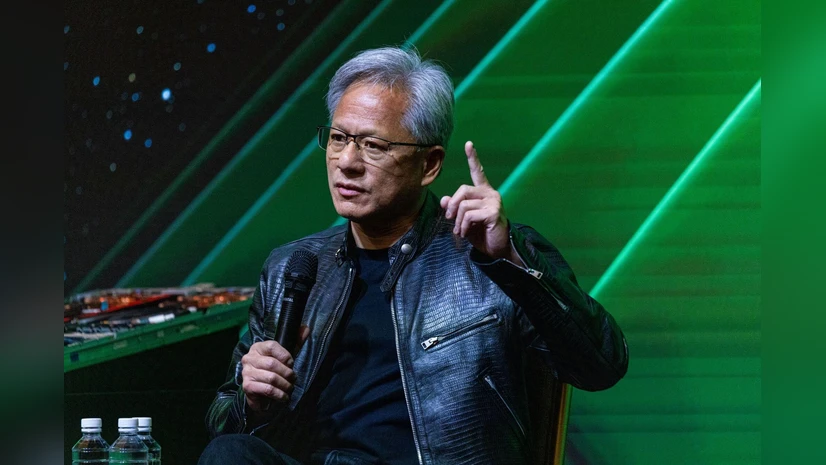

4. Nvidia and tech rally

Nvidia’s continued rally added momentum to global tech stocks, reinforcing confidence in the AI-driven growth story. This indirectly benefits Indian IT firms catering to AI, data analytics, and semiconductor development.

5. Crude oil price movement

Oil prices slipped slightly amid expectations of stable demand and geopolitical uncertainty. For India, a major oil importer, this trend could ease inflationary pressure and improve market sentiment in energy and transport sectors.

6. Currency market reactions

The US dollar softened against major currencies after the Fed’s decision. The Indian rupee may see limited volatility but could gain marginally if foreign inflows increase due to the rate cut.

7. Domestic earnings updates

Several Indian companies are set to release quarterly results this week, which could determine short-term market direction. Sectors like banking, energy, and consumer goods remain in focus for investors.

8. Retail participation outlook

Retail investors from Tier 2 and Tier 3 cities continue to play a larger role in India’s trading landscape. Lower global rates could make equities more attractive compared to traditional savings, but experts urge caution amid market fluctuations.

Conclusion

As trading resumes, India’s markets are expected to react to both global cues and local fundamentals. The mix of optimism from the Fed’s decision, stability in oil prices, and strong tech momentum could set a positive tone. For smaller investors, the key will be to balance short-term enthusiasm with a steady focus on long-term financial discipline.