Now Reading: India PCB manufacturing sector set to hit $14 billion by 2030

-

01

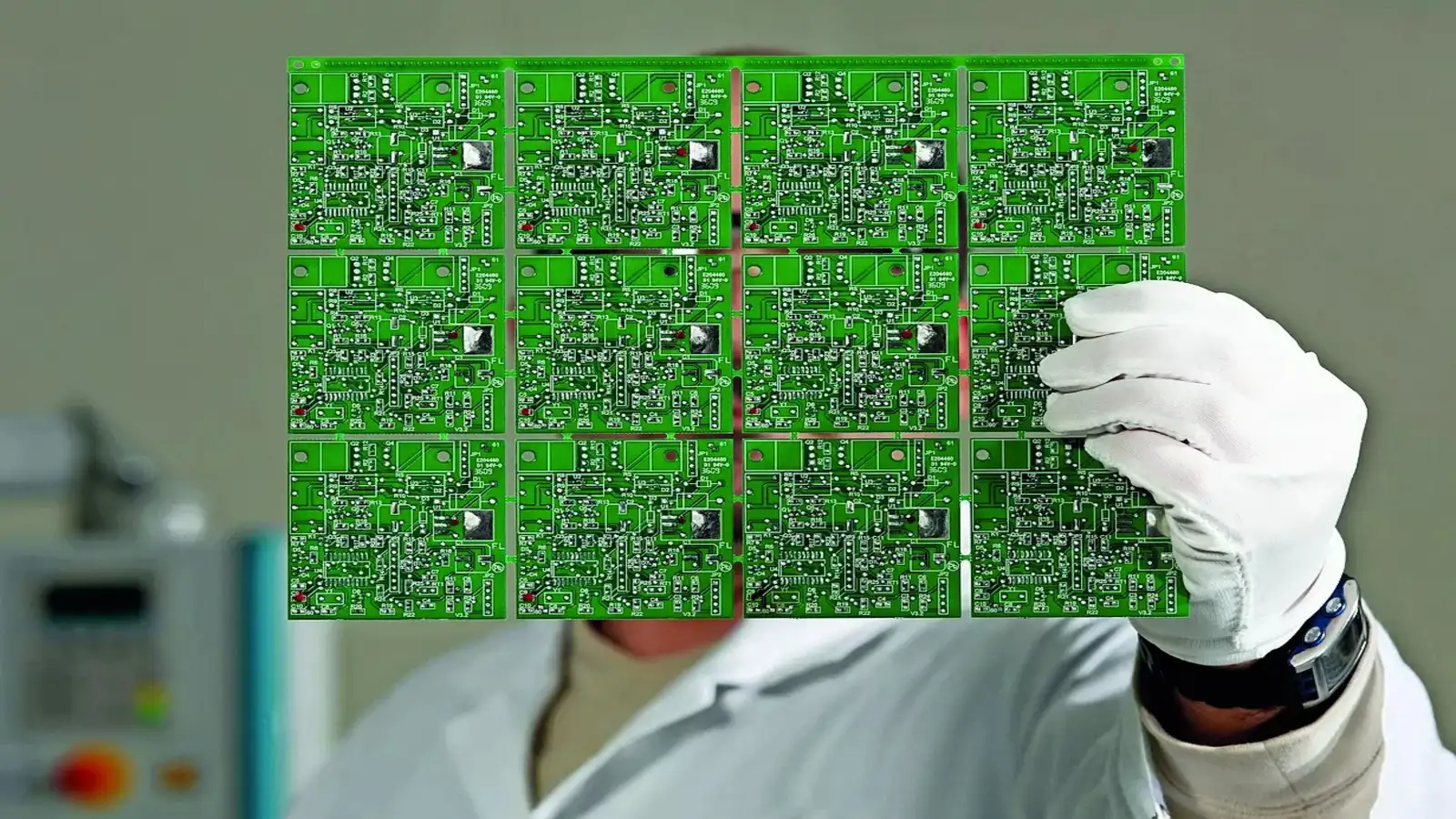

India PCB manufacturing sector set to hit $14 billion by 2030

India PCB manufacturing sector set to hit $14 billion by 2030

India’s PCB manufacturing sector is projected to reach nearly $14 billion by 2029-30, highlighting a major shift toward domestic production in the electronics components industry as part of the country’s self-reliance push.

Strong growth projection and strategic importance

The main keyword “PCB manufacturing sector” appears in the opening sentence. A recent industry report by the Electronic Industries Association of India (ELCINA) and Feedback Advisory projects that India’s domestic printed circuit board (PCB) manufacturing value will reach about US $14 billion by FY 2029-30. This growth would represent approximately 10 % of the government’s broader electronics components manufacturing target of US $150 billion. The forecast comes as India expands its electronics manufacturing ecosystem and seeks to reduce imports of PCBs and other upstream components.

Drivers of the PCB market expansion

Under the secondary keyword “electronics components manufacturing India”, several factors are aligning to drive growth. First, rising demand from end-use sectors: consumer electronics, telecommunications (especially 5G infrastructure), automotive electronics (including EVs) and industrial electronics all require more PCBs. Second, government initiatives such as the Production Linked Incentive (PLI) scheme for electronics and component manufacturing boost capacity expansion and investment in domestic PCB fabrication. Third, global supply-chain shifts away from China and increasing localisation efforts are pushing global OEMs and Indian EMS/ODM players to source PCBs from India. Lastly, rising quality, multilayer and high-density interconnect (HDI) PCBs are becoming more prevalent, supporting higher value manufacturing rather than only low-end boards.

Capacity, investment and infrastructure trends

Using the keyword “PCB manufacturing investments India”, the report highlights emerging investment activity. Indian PCB manufacturers and global partners are scaling up to meet domestic and export demand. For example, firms such as Kaynes Circuits India have announced large-scale PCB and component plants (including HDI and multi-layer PCB facilities) under government-backed incentives. Through these investments, India is building deeper domestic capacity, enhancing fabrication, laminate and assembly ecosystems, and reducing lead-time and cost disadvantages. States such as Tamil Nadu, Andhra Pradesh and Maharashtra are becoming hubs for PCB clusters owing to favourable policy and infrastructure.

Challenges and risk factors ahead

With the keyword “PCB manufacturing challenges India”, the sector must navigate several headwinds despite strong growth potential. Raw materials and inputs like copper foil, laminates and specialised resins remain largely imported, exposing manufacturers to forex and supply-chain risks. Scaling advanced PCB types (for telecom infrastructure, EV electronics) requires significant capital, skilled labour and process maturity. Competitive pressure from established global PCB hubs like China and Taiwan means Indian units must upgrade productivity and technology to stay cost-competitive. Regulatory, environmental and quality standards also demand rigorous compliance. Lastly, demand cycles in end-markets such as consumer electronics or auto can be volatile, which may impact utilisation and profitability of new PCB capacity.

Implications for domestic electronics ecosystem

Under the secondary keyword “localisation of electronics supply chain India”, the growth of PCB manufacturing signals a deeper transformation within India’s electronics industry. As PCB production strengthens, domestic EMS/ODM firms can rely less on imports, improving margin, reducing currency exposure and shortening supply-chains. For OEMs, locally-sourced high-density PCBs enable faster innovation and assembly. For states and investors, this offers new manufacturing jobs, export potential and industrial clustering. The forecast value of US $14 billion for PCBs alone indicates that upstream components manufacturing is becoming a significant chunk within India’s broader electronics ambitions.

Takeaways

- India’s PCB manufacturing sector is projected to reach nearly US $14 billion by FY 2029-30, representing a substantial rise in domestic electronics component value.

- Growth is driven by strong demand in consumer electronics, automotive electronics (EVs), telecom infrastructure and government localisation initiatives.

- Major investments in multi-layer and HDI PCB capacity are underway, but import dependence on raw materials and global competition remain key risks.

- Strengthening PCBs domestically has broad implications: shorter supply-chains, higher value-add for domestic industry and potential exports.

FAQ

Q1: What types of PCBs will drive most of the growth in India?

Advanced types like multi-layer, HDI (high-density interconnect) and flexible/rigid-flex PCBs will capture higher growth due to demand from telecom (5G), EVs and complex electronics. Basic single- or double-layer boards will continue but contribute less incremental value.

Q2: Why is the US $14 billion figure significant for India’s electronics sector?

This figure is roughly 10 % of India’s target of US $150 billion in electronics components manufacturing, indicating that PCB manufacturing alone will be a key pillar of the localisation drive.

Q3: What major challenges could derail this growth?

Challenges include dependency on imported raw materials and components, need for technical/trained workforce, scaling advanced PCB manufacturing cost-effectively, stiff international competition and end-market demand volatility.

Q4: How can companies benefit from this growth in the PCB manufacturing sector?

Companies that invest early in high-value PCB types, build local supply-chain partnerships, align with government incentive schemes and serve fast-growing domains (EVs, telecom, industrial electronics) stand to gain the most from this sector expansion.