Now Reading: Gold Prices Break Bullish Trend Line, Market Signals Caution Ahead

-

01

Gold Prices Break Bullish Trend Line, Market Signals Caution Ahead

Gold Prices Break Bullish Trend Line, Market Signals Caution Ahead

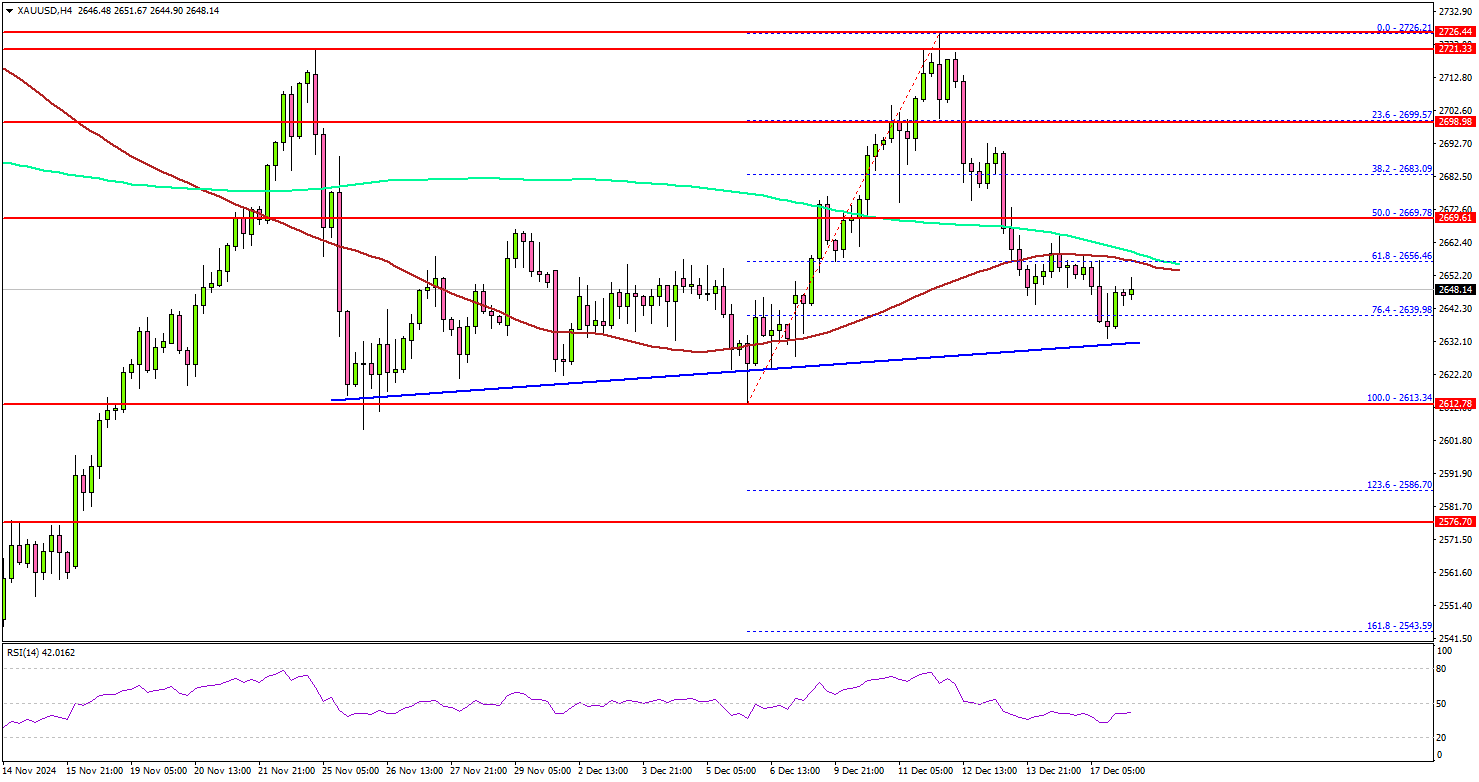

Gold prices have broken below a key bullish trend line, signaling a potential shift in momentum for global investors and traders. After months of steady gains, this technical movement has triggered fresh analysis on whether the metal’s upward journey is slowing — or if it’s just a temporary dip in a larger cycle.

In India, where gold plays a central role in both economy and culture, the shift could have ripple effects across markets and households.

A Pause in the Rally?

For most of 2025, gold prices had been climbing steadily, driven by global economic uncertainty, geopolitical tensions, and investor preference for safe-haven assets. However, the recent price movement broke a well-established upward trend, indicating reduced bullish strength.

Technical analysts are now watching support levels closely, as a further decline could signal a correction phase or increased volatility in the near term.

Why This Matters for Indian Consumers

In India, gold isn’t just an investment — it’s tradition. From weddings in Jaipur and Coimbatore to festivals in Indore and Raipur, demand for physical gold is strong, especially in Tier 2 cities.

A drop in prices could lead to a surge in retail purchases, particularly by jewellers looking to stock up. However, uncertainty in global pricing may also prompt consumers to wait and watch, impacting short-term demand patterns.

Impact on Traders and Importers

Indian gold traders and importers, who follow international price trends closely, are likely to reassess their strategies. If the bearish trend holds, it may offer temporary cost advantages for bullion importers, especially ahead of the festive season.

On the flip side, currency fluctuations and customs duties could offset some of these benefits. For cities with active bullion markets like Ahmedabad, Surat, and Lucknow, pricing strategies may need to be adjusted to protect margins.

Investment Sentiment Remains Mixed

While physical gold buyers may welcome lower prices, investors in gold ETFs or digital gold are adopting a more cautious stance. The break in the trend line raises concerns about short-term losses, prompting some to rebalance their portfolios toward equities or bonds.

Experts advise a wait-and-watch approach, as macroeconomic indicators and global interest rates will play a key role in shaping gold’s next move.

Conclusion

The recent break in gold’s bullish trend line has introduced a new layer of uncertainty for markets and consumers alike. While it may offer buying opportunities for some, it also signals the need for careful decision-making, especially in India where gold is both a financial and emotional asset. As the market recalibrates, all eyes remain on how global cues and domestic demand will shape gold’s journey ahead.