Now Reading: Adani Group Stocks Surge by ₹66,000 Crore Following SEBI’s Clean Chit

-

01

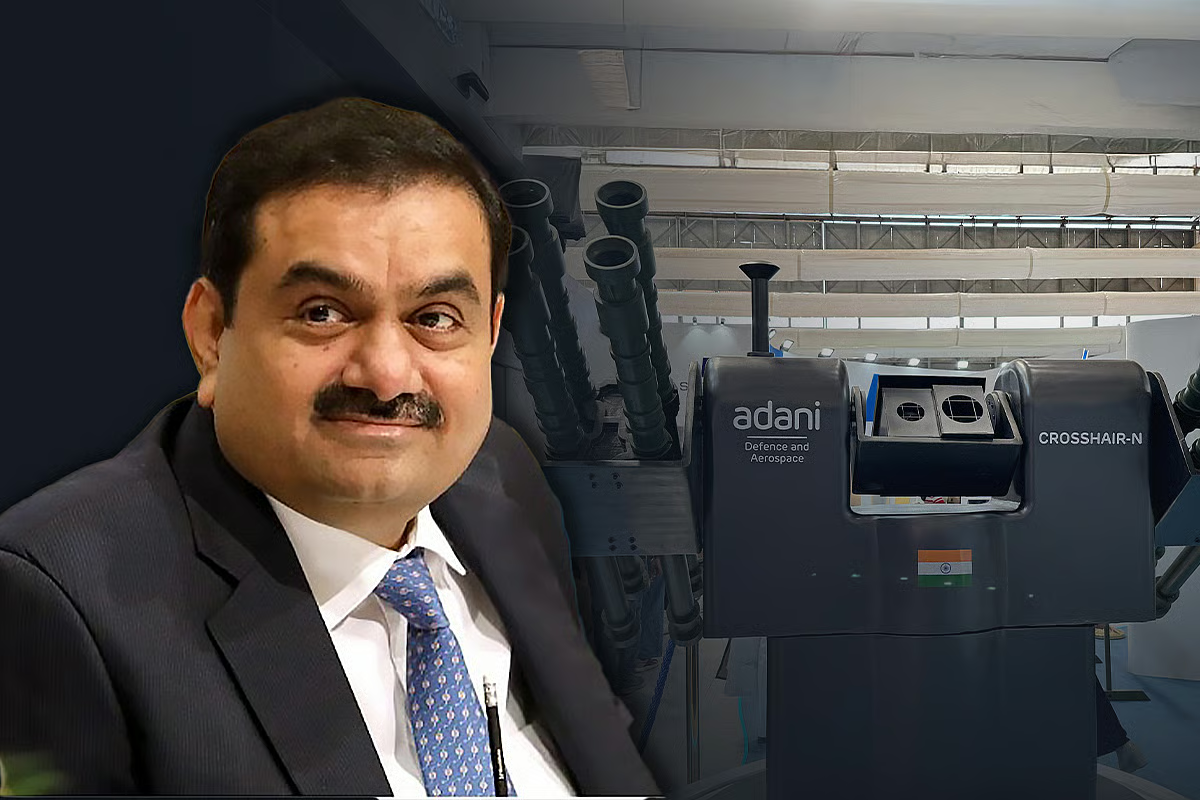

Adani Group Stocks Surge by ₹66,000 Crore Following SEBI’s Clean Chit

Adani Group Stocks Surge by ₹66,000 Crore Following SEBI’s Clean Chit

Shares of Adani Group companies experienced a significant rally, adding ₹66,000 crore to their market capitalization in a single day. This surge follows the Securities and Exchange Board of India’s (SEBI) exoneration of the conglomerate and its founder, Gautam Adani, from allegations of stock manipulation and accounting fraud. The favorable ruling has restored investor confidence, leading to substantial gains across the group’s listed entities.

SEBI’s Verdict and Market Reaction

On Thursday, SEBI concluded its investigation into the allegations raised by Hindenburg Research, finding no evidence of fraudulent transactions or misuse of funds. The regulator determined that the transactions in question were regular loan activities with proper returns and did not qualify as related-party transactions, thus not violating listing agreements. This clearance led to a surge in Adani Group stocks, with Adani Power rising by 12.4%, and other companies like Adani Total Gas, Adani Green Energy, Adani Enterprises, NDTV, and Adani Energy Solutions jumping between 4% and 8% on Friday.

Investor Sentiment and Future Outlook

The market’s positive response reflects renewed investor confidence in the Adani Group’s governance and financial practices. However, while the SEBI ruling addresses specific allegations, other investigations, including those by the U.S. Department of Justice, remain ongoing. Analysts suggest that while the immediate outlook has improved, investors should continue to monitor developments closely.

Conclusion

The SEBI’s clean chit has provided a significant boost to Adani Group stocks, marking a pivotal moment in the conglomerate’s efforts to restore its reputation and investor trust. As the group continues to navigate regulatory scrutiny, the market’s response underscores the importance of transparency and adherence to financial regulations in maintaining investor confidence.