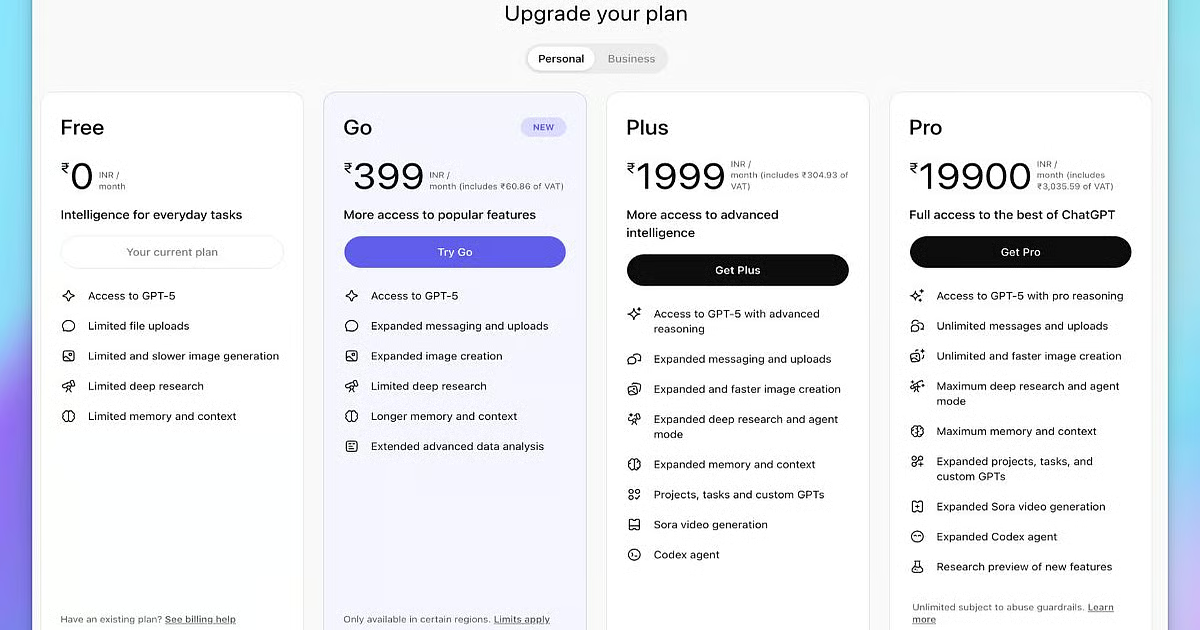

Now Reading: ChatGPT Go free rollout in India sparks UPI payment backlash

-

01

ChatGPT Go free rollout in India sparks UPI payment backlash

ChatGPT Go free rollout in India sparks UPI payment backlash

The ChatGPT Go free offer in India has drawn strong public interest, but the rollout has also triggered user frustration due to UPI payment verification glitches. Many users attempting to activate account features or optional usage add ons reported failed authentication loops, delayed payment prompts or missing verification requests across major UPI apps. The issue highlights the scale and complexity of digital payment infrastructure when high volume rollout meets inconsistent bank API load handling.

The matter has gained visibility across social platforms, where users shared screenshots of stuck UPI mandates or repetitive debit message notifications. While the core ChatGPT Go free usage does not require payment in most cases, optional verification steps during onboarding triggered challenges for a large share of users. This situation shows the difference between headline interest in AI tools and the practical backend dependencies required for smooth adoption.

High demand meets payment system congestion

The demand for ChatGPT Go in India was expected to be large. India has one of the world’s highest rates of digital learning adoption, freelancing, exam preparation, small business documentation and creator economy growth. ChatGPT’s free tier directly serves use cases such as quick drafting, language support, workflow planning and research assistance. The rollout coincided with increasing discussions around affordable AI tools.

However, verification and identity confirmation during onboarding rely on micro transaction pings through UPI frameworks. When a sudden surge of requests hits gateways, payment API layers can time out or queue transactions. Banks respond differently depending on server load, maintenance cycles and internal traffic policies. This leads to an uneven experience where the same user may succeed with one UPI app and fail with another.

For many users, the frustration stemmed from lack of clear feedback. Instead of error detail, apps often displayed generic timeout messages, giving the impression of malfunction rather than network congestion. This reflects a long standing issue in digital payments: instant payments work well at scale, but micro verification workflows are more sensitive to load spikes.

Why UPI specifically becomes the pressure point

UPI is a real time payment framework connecting banks, merchant gateways and user apps. While it is extremely reliable for high volume consumer transactions, authentication tasks function differently. These require synchronous confirmations between multiple layers: the app, the UPI handler, NPCI routing, and the user’s bank.

If any layer slows down, the transaction appears stuck. In onboarding scenarios, this problem becomes more visible because users expect one click activation. For organizations offering high volume subscription models, UPI mandates must align with bank level risk limits and transaction sequencing rules.

In a mass rollout event, especially one involving millions of app installs within a short period, verification attempts can cluster in time. Banks then initiate temporary throttling to maintain network stability. This is likely what led to the wave of timeouts experienced during the ChatGPT Go activation period.

Platform response and short term adjustments

Support channels acknowledged the issue and advised users to wait before retrying verification. In many cases, ChatGPT Go remains usable without immediate completion of the optional UPI based steps. Users can access core AI assistance, chat functions and drafting support without linking payments.

Developers are likely to adjust verification retry logic, extend time windows for callback acknowledgment, and introduce alternative verification methods such as card tokenization or delayed mandate approval. This pattern is consistent with how other global digital platforms have adapted to UPI scale behavior.

Users discovered workarounds, including switching to a different UPI app, using a bank with faster response history, or delaying verification to late night or early morning windows, when transaction traffic is typically lighter.

Broader implications for India’s AI adoption curve

The incident does not reflect declining demand for AI services. Instead, it shows that infrastructure alignment is part of the adoption curve. India’s digital ecosystem is extremely large but also variable across banks and devices. Mass scale AI services must account for backend realities, not just frontend user interest.

The long term trend remains clear: India is positioned to become one of the largest AI consumer markets globally. The willingness to try new digital tools is strong. However, sustained adoption depends on clear onboarding, low friction activation and transparent communication when systems face temporary stress.

The UPI backlash illustrates that even widely trusted infrastructure requires adaptation when new categories of high traffic digital services enter the market. The resolution will likely involve collaborative technical adjustments rather than policy intervention.