Now Reading: Electric Vehicle Sales Show Strong Growth in Urban India

-

01

Electric Vehicle Sales Show Strong Growth in Urban India

Electric Vehicle Sales Show Strong Growth in Urban India

Electric vehicle sales show strong growth in urban India as rising fuel costs, improving charging infrastructure, and supportive policy measures accelerate adoption across major cities. From two wheelers to passenger cars, urban consumers are increasingly shifting toward electric mobility for cost efficiency and convenience.

The topic is time sensitive and news driven. The tone below reflects recent sales trends, market dynamics, and verified industry patterns shaping electric vehicle adoption in Indian cities.

Urban India Drives the Latest Electric Vehicle Sales Surge

Electric vehicle sales in urban India have recorded consistent growth over the past year, with metros and Tier 1 cities leading the shift. Higher population density, shorter commute distances, and better access to charging infrastructure have created ideal conditions for EV adoption.

Cities such as Bengaluru, Delhi, Mumbai, Pune, Hyderabad, and Chennai account for a large share of new electric vehicle registrations. Urban buyers are showing greater willingness to experiment with new technology, particularly in the two wheeler and three wheeler segments.

Rising petrol and diesel prices continue to influence purchasing decisions. For daily commuters, the lower running cost of electric vehicles offers a clear financial advantage, especially in traffic heavy urban environments where fuel efficiency drops sharply for conventional vehicles.

Two Wheelers and Three Wheelers Lead EV Adoption

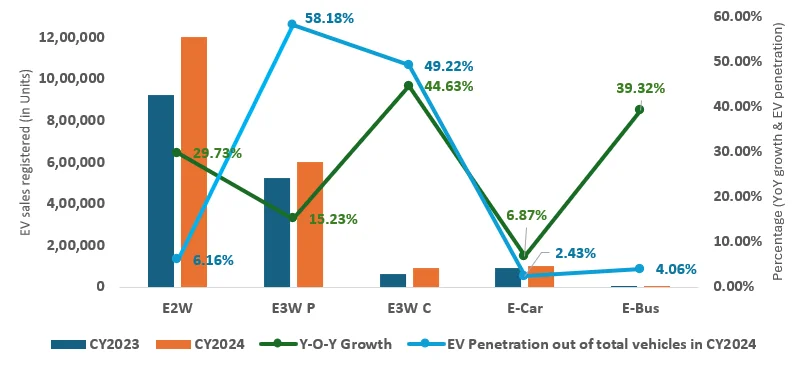

Two wheelers remain the backbone of electric vehicle sales growth in urban India. Electric scooters and motorcycles are gaining traction among office commuters, delivery executives, and college students due to low operating costs and easy charging options.

Three wheelers used for passenger transport and last mile delivery are also witnessing strong demand. Fleet operators are rapidly electrifying to reduce fuel expenses and meet sustainability targets. Many urban transport hubs now feature dedicated charging points for electric autos.

The affordability gap between electric and petrol models in these segments has narrowed significantly. Government incentives and manufacturer pricing strategies have helped make electric options more competitive, particularly for buyers evaluating long term ownership costs.

Passenger Electric Cars See Steady Urban Uptake

While electric cars still represent a smaller share of total vehicle sales, urban demand is rising steadily. Buyers in cities are increasingly viewing electric cars as secondary vehicles suited for daily commuting rather than long distance travel.

Improved battery ranges and growing fast charging networks have reduced range anxiety. Urban users typically drive within predictable distances, making current EV ranges practical for most needs.

Corporate leasing and fleet purchases are also supporting electric car sales in cities. Many companies are integrating EVs into employee transport and ride hailing services, further boosting urban adoption.

Charging Infrastructure Expansion Supports Growth

One of the key enablers behind electric vehicle sales growth in urban India is the rapid expansion of charging infrastructure. Public charging stations are now available at malls, office complexes, metro stations, parking lots, and fuel pumps across major cities.

Residential charging remains the primary mode for most EV owners, especially in apartment complexes with designated parking. Builders and housing societies are increasingly installing EV ready electrical setups to meet growing demand.

Fast charging corridors within cities have improved confidence among potential buyers. Reduced charging times make EV ownership more practical for users with tight schedules and high daily usage.

Policy Support and Incentives Influence Urban Buyers

Government policies continue to play a critical role in driving electric vehicle sales. Subsidies, tax benefits, and reduced registration charges have made EVs more attractive in urban markets.

Several state governments offer additional incentives such as road tax exemptions, priority parking, and lower toll fees. These benefits are particularly relevant for city residents who face high recurring transport costs.

Urban consumers are also influenced by future oriented regulations aimed at reducing pollution. Restrictions on older internal combustion vehicles in certain cities have encouraged buyers to consider electric alternatives proactively.

Consumer Mindset Shifts Toward Sustainable Mobility

Beyond economics, changing consumer attitudes are shaping electric vehicle sales trends. Urban buyers are more aware of environmental concerns and air quality issues, especially in cities with high pollution levels.

Electric vehicles are increasingly seen as modern and technology driven choices rather than compromises. Features such as connected apps, silent operation, and low maintenance appeal to younger urban professionals.

Word of mouth and visible adoption play a strong role in cities. As more EVs appear on urban roads, hesitation among first time buyers continues to decline.

Challenges That Still Need Addressing

Despite strong growth, challenges remain. Charging access in older residential buildings is uneven, and peak hour grid load management requires attention. Service network expansion is still catching up in some cities.

Battery replacement costs and resale value concerns persist among cautious buyers. Manufacturers and policymakers are addressing these issues through extended warranties and battery recycling initiatives.

Even with these hurdles, the overall trajectory of electric vehicle sales in urban India remains firmly upward.

Takeaways

Urban India is leading electric vehicle sales growth across segments

Two wheelers and three wheelers are driving mass EV adoption

Improving charging infrastructure is boosting buyer confidence

Policy incentives and fuel costs are accelerating the shift to EVs

FAQs

Why are electric vehicle sales higher in urban India?

Urban areas offer better charging access, shorter commute distances, and higher fuel cost savings.

Which EV segment is growing the fastest in cities?

Electric two wheelers and three wheelers are seeing the fastest growth due to affordability and utility.

Are electric cars practical for city use?

Yes. Current ranges and charging options are well suited for daily urban commuting.

What is the biggest challenge for urban EV adoption?

Charging access in older residential areas and long term battery costs remain key concerns.