Now Reading: Indian Markets Open Lower as Global Cues and Tariff Talks Weigh on Investors

-

01

Indian Markets Open Lower as Global Cues and Tariff Talks Weigh on Investors

Indian Markets Open Lower as Global Cues and Tariff Talks Weigh on Investors

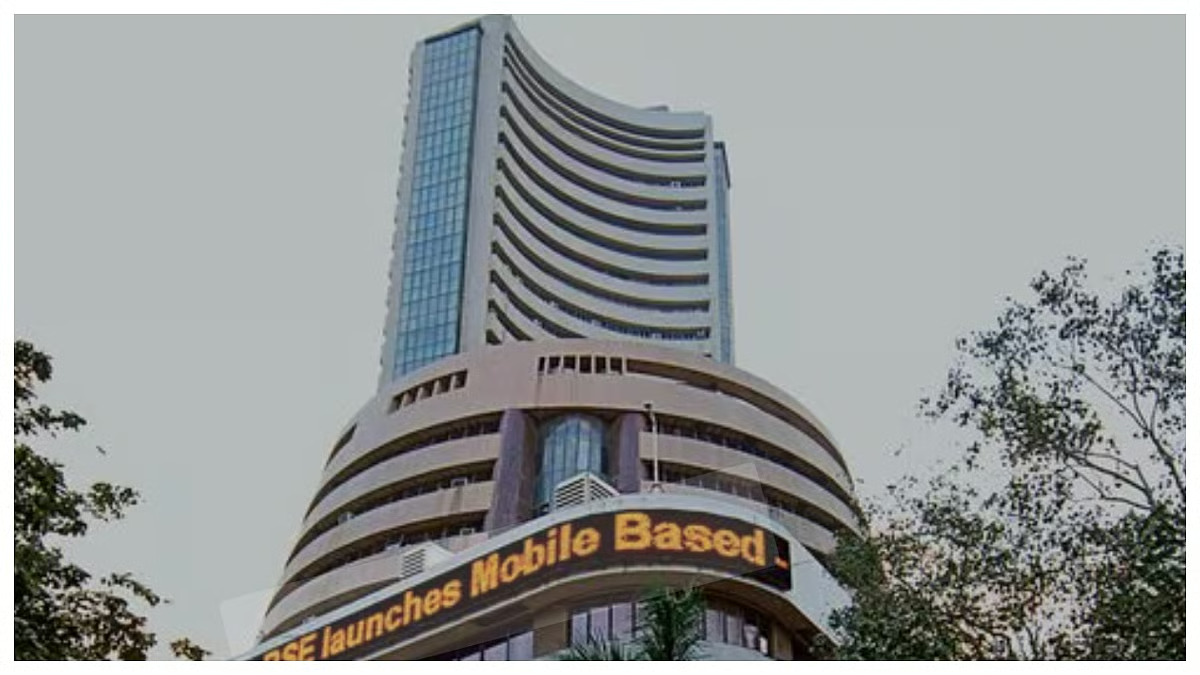

Dalal Street witnessed a cautious session on Thursday, with Nifty50 and BSE Sensex opening lower amid global market jitters and concerns over international trade developments. Investors remained wary after reports on potential US tariff policies under former President Donald Trump, prompting a defensive approach across sectors. Market participants closely watched both domestic economic indicators and overseas cues for direction.

Market Movement and Sector Performance

The Nifty50 opened in the red, tracking weak global sentiment and mixed Asian market performance. Banking and IT stocks showed moderate selling pressure, while energy and metal stocks managed minor gains. Traders highlighted that foreign institutional investors were cautious ahead of upcoming economic data and policy announcements.

Global Factors Influencing Markets

Global equities have been volatile following renewed discussions on trade tariffs and geopolitical developments. Investors in India are factoring in these external pressures, as export-dependent sectors could feel the impact of tariff escalations. The ripple effect is especially relevant for mid-cap and small-cap stocks, which are sensitive to global demand fluctuations.

Implications for Tier 2 Cities and Retail Investors

Markets in Tier 2 cities, where retail participation is growing, are closely tracking such news. Investors here often rely on local brokers and news platforms to navigate volatility. Caution is being advised, particularly for short-term trades, as global cues could lead to sudden market swings.

Analyst Perspectives

Experts suggest that while the short-term trend may remain subdued, long-term fundamentals of the Indian economy are stable. They advise investors to focus on sectors showing resilience to global shocks and to maintain a diversified portfolio to manage risk effectively.

Conclusion

Thursday’s cautious opening on Dalal Street reflects a blend of global uncertainty and domestic market prudence. While investors navigate tariff discussions and geopolitical developments, careful monitoring of sectoral trends and disciplined investment strategies will be key to managing volatility in the near term.