Now Reading: Indian-Origin CEO Bankim Brahmbhatt Accused of ‘Breathtaking’ $500 Million Fraud at BlackRock

-

01

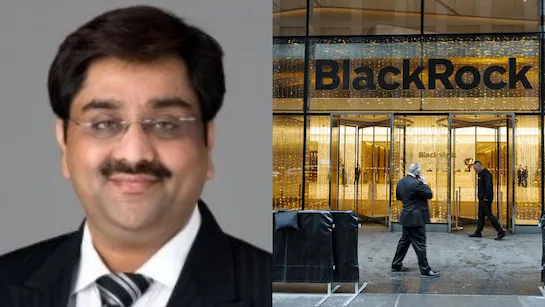

Indian-Origin CEO Bankim Brahmbhatt Accused of ‘Breathtaking’ $500 Million Fraud at BlackRock

Indian-Origin CEO Bankim Brahmbhatt Accused of ‘Breathtaking’ $500 Million Fraud at BlackRock

Indian-origin telecom executive Bankim Brahmbhatt has been accused of orchestrating a massive fraud worth over $500 million targeting BlackRock’s private-credit arm and other lenders. The allegation centres on fabricated invoices and accounts receivable used as collateral for loans, raising serious questions about due diligence in global credit markets and the vulnerability of even large investors.

Background of the Accusation

Brahmbhatt, who headed US-based telecom services firms such as Broadband Telecom and Bridgevoice, reportedly secured large loans from BlackRock’s HPS Investment Partners and other lenders. In turn he is accused of presenting fictitious customer receivables as collateral, and of transferring assets offshore. The case alleges that nearly every email submitted by his companies over a two-year period was fake.

How the Fraud Allegedly Unfolded

According to lenders’ claims, initial investments began in September 2020 and ballooned to hundreds of millions by August 2024. Amid these loans, warning signs emerged—fake email domains, unverifiable customer contracts, and eventually the abrupt disappearance of both companies and the executive’s known offices. Brahmbhatt’s companies and several subsidiary financing firms filed for bankruptcy, while his whereabouts remain unclear.

Implications for India-Connected Investors and Tier 2 Cities

For Indian investors, especially those in Tier 2 cities now increasingly exploring global investments or credit markets, this incident signals that international financial links carry hidden risks. It underscores the need for transparency and vigilance in cross-border business dealings and serves as a warning that even high-profile institutions can be exposed to sophisticated fraud.

Legal and Corporate Fallout

BlackRock and its affiliated lenders have initiated recovery efforts, inspecting asset pledges and pursuing legal action. The case is being watched closely by regulators and investors alike, as it may prompt tighter controls on asset-based financing and greater scrutiny of collateral verification. The outcome could reshape how global credit is extended and secured—impacting companies and investors in India and worldwide.

Conclusion:

The case against Bankim Brahmbhatt reflects not just an alleged single fraud but a broader challenge for global finance. For India’s growing pool of investors and entrepreneurs—even in smaller cities—the episode is a reminder that doing business internationally requires far more than ambition. It requires rigorous checks, awareness of regulatory systems and a clear understanding of the risks that lurk when money, technology and cross-border operations intersect.