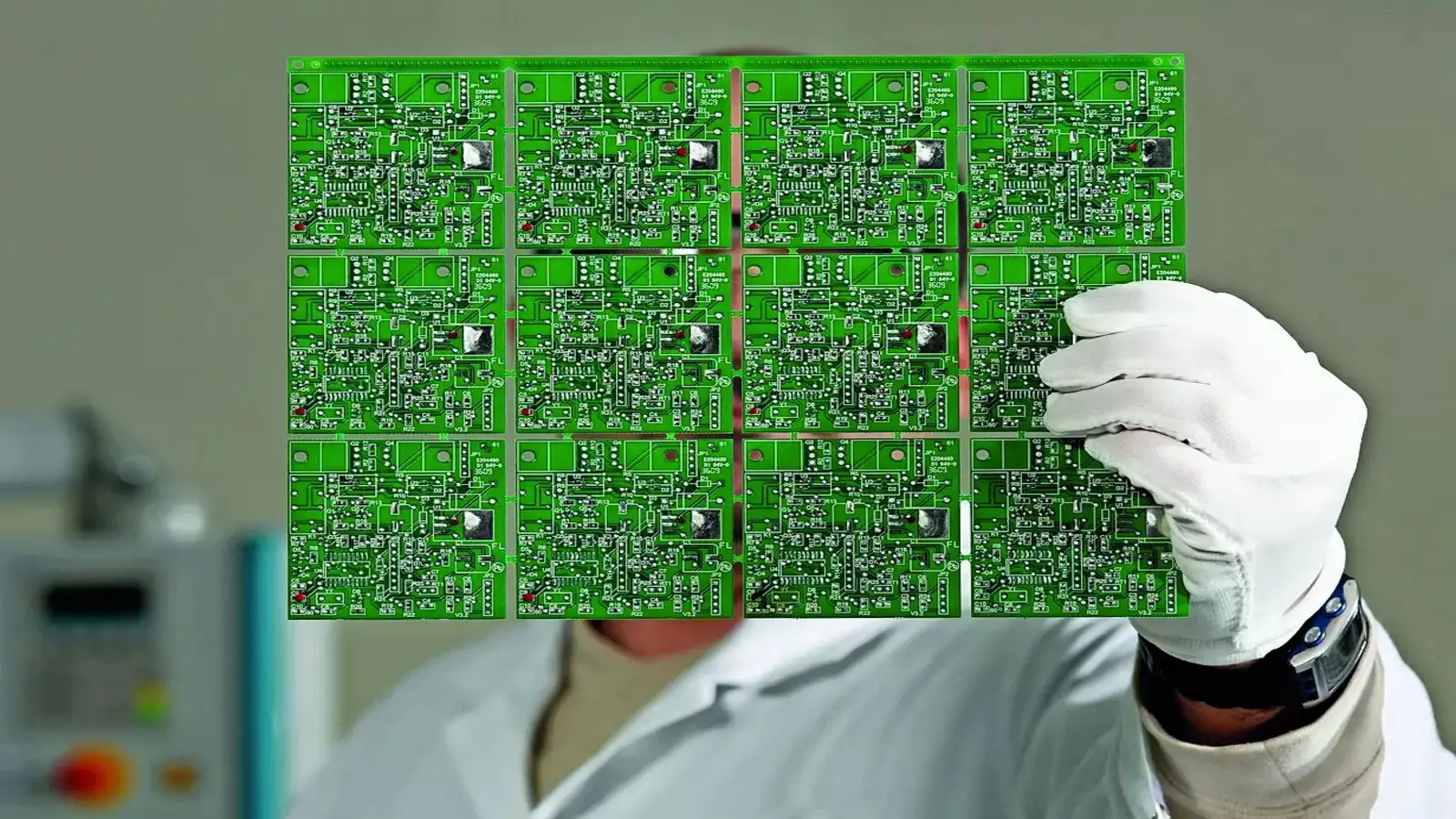

Now Reading: India’s PCB Manufacturing Industry Set to Hit $14 Billion by 2030

-

01

India’s PCB Manufacturing Industry Set to Hit $14 Billion by 2030

India’s PCB Manufacturing Industry Set to Hit $14 Billion by 2030

India’s printed circuit board (PCB) manufacturing industry is projected to reach $14 billion by 2030, driven by rapid electronics demand, local supply chain development, and government incentives under the Make in India and semiconductor mission initiatives.

India’s PCB Industry Enters Rapid Expansion Phase

India’s PCB manufacturing industry is witnessing unprecedented growth, positioning itself as a key player in the global electronics ecosystem. According to a new industry report, the domestic PCB market is expected to touch $14 billion by 2030, nearly tripling from its current size. The India PCB manufacturing industry is being propelled by robust demand from sectors such as consumer electronics, automotive, telecommunications, and defense. Analysts attribute the surge to both rising local consumption and strategic government initiatives aimed at strengthening India’s electronics manufacturing base. The push for indigenous semiconductor and hardware production has further elevated the role of PCBs as a critical backbone of modern technology.

Electronics Boom Fuels PCB Market Growth

The expanding electronics market in India forms the core driver of this surge. As smartphone, laptop, and home appliance usage grows across urban and rural markets, the demand for high-quality printed circuit boards has skyrocketed. The government’s Production-Linked Incentive (PLI) schemes have encouraged domestic and international players to set up advanced PCB units in states like Tamil Nadu, Gujarat, and Uttar Pradesh. In addition, the automotive sector’s transition toward electric vehicles (EVs) has intensified demand for specialized PCBs capable of handling high power and thermal management. Industry insiders believe that this combination of factors positions India as one of the fastest-growing PCB markets globally.

Government Policies Accelerate Local Manufacturing

Under the Digital India and Make in India campaigns, the government has prioritized the development of a self-reliant electronics supply chain. Programs such as the India Semiconductor Mission (ISM) and the Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS) have been instrumental in attracting global investment. These initiatives aim to reduce dependence on imports from China and Southeast Asia. As part of these efforts, the government has approved several greenfield and brownfield projects for PCB fabrication and assembly. With lower import duties on raw materials and financial incentives for local manufacturers, India is creating a competitive environment that rivals traditional production hubs in East Asia.

Technology Innovation and Skill Development Key to Growth

Technological advancement in multilayer and flexible PCBs is reshaping the domestic market. Indian firms are moving beyond single- and double-layer boards to develop complex circuits for advanced electronics applications. Companies are investing in automated manufacturing lines, precision testing equipment, and environmentally sustainable production methods. To sustain this momentum, the industry is also focusing on skill development. Institutions and industry bodies are collaborating to train engineers and technicians in PCB design, fabrication, and quality control. This skill-oriented approach ensures India can meet not only domestic needs but also export opportunities.

Rising Exports and Global Partnerships

India’s PCB exports are gradually expanding as foreign companies partner with local manufacturers to diversify supply chains. Global tech giants are increasingly viewing India as a reliable sourcing destination amid growing geopolitical tensions and the push for supply chain diversification. The government’s emphasis on export competitiveness, along with free trade zone benefits and logistics improvements, has helped Indian PCB firms secure international orders. By 2030, exports are projected to account for nearly 25% of total production, up from just 10% today.

Challenges in Raw Material and Technology Dependence

Despite the progress, the industry still faces hurdles. A large portion of raw materials such as copper foil, laminates, and photoresists continue to be imported. High capital investment and technology dependence on foreign suppliers pose challenges for scaling up local capabilities. Industry experts suggest that sustained R&D spending and joint ventures with international technology partners will be essential to overcome these limitations. Additionally, the need for stronger waste management policies and environmentally safe production remains a key concern as manufacturing volumes increase.

Outlook: India’s Strategic Push Toward Electronics Independence

The projected $14 billion milestone for the PCB industry symbolizes more than just economic growth. It represents India’s strategic intent to emerge as a complete electronics manufacturing hub capable of supporting global brands. With infrastructure improvements, policy backing, and technological progress converging, India is well-positioned to capitalize on the next wave of digital and industrial transformation. If current trends continue, India could not only achieve self-reliance in PCBs but also become an exporter of advanced electronic hardware by the end of the decade.

Takeaways:

- India’s PCB manufacturing industry is projected to reach $14 billion by 2030.

- Government policies under Make in India and ISM are driving rapid growth.

- Domestic and global electronics demand is fueling expansion and exports.

- Challenges remain in raw material sourcing and technology independence.

FAQs

Q1: What is driving India’s PCB market growth?

The surge is driven by rising electronics demand, EV production, government incentives, and the expansion of the semiconductor ecosystem under national programs.

Q2: Which sectors use PCBs the most in India?

Consumer electronics, automotive, telecom, aerospace, and defense are the major sectors relying on PCBs for their operations.

Q3: How is the government supporting the PCB industry?

Through initiatives like Make in India, PLI schemes, and the Semiconductor Mission, the government provides financial incentives, tax benefits, and infrastructure support.

Q4: What challenges does the industry face?

India still imports key raw materials and high-end machinery. Increasing domestic R&D and sustainable production practices will be vital to address these issues.