Now Reading: Markets at a Crossroads: 10 Factors Set to Shape Tuesday’s Trading Session

-

01

Markets at a Crossroads: 10 Factors Set to Shape Tuesday’s Trading Session

Markets at a Crossroads: 10 Factors Set to Shape Tuesday’s Trading Session

India’s stock markets are headed into a Tuesday session filled with uncertainty, as multiple economic and global cues converge. From rate cut expectation shifts to U.S. draft tariffs looming over exports, investors are bracing for volatility—and preparing to recalibrate strategies as key signals emerge.

At the outset, optimism built on Fed Chair Jerome Powell’s comments on possible rate cuts has buoyed Indian markets, with IT stocks rallying and benchmarks rising. But that confidence is fragile, as new U.S. tariff proposals threaten export-driven sectors. Here are the ten key factors likely to influence market action.

- Global Rate Expectations: Powell’s dovish stance continues to fuel hopes of a U.S. rate cut next month, keeping sentiment upbeat for equity markets.

- Tariff Tensions: India is bracing for up to 50% U.S. tariffs on several key exports, prompting exporters to race shipments before the deadline—and rattling investor confidence.

- Domestic Earnings: Company results, especially from IT and other heavyweight sectors, will be closely watched for signs of resilience amid the macro noise.

- Global Market Moves: European and U.S. markets’ performance today could influence local trading direction, with investors watching for cues from international trends.

- Technical Price Levels: Chart watchers will keep an eye on market support and resistance zones, wary of possible shifts if technical patterns break.

- Stock-Specific Momentum: High-volume and large-mover stocks may draw heightened trading interest—even if broader market action remains subdued.

- Sector Rotation: Shifts between defensive sectors (like pharma or FMCG) and riskier plays (like midcaps) could signal broader sentiment shifts.

- FII Activity: Flows from foreign institutional investors remain a key driver—any net buying or selling could sway market direction.

- Macro Indicators: Data such as the rupee’s movement, crude prices, and inflation signals could prompt swift repositioning by traders.

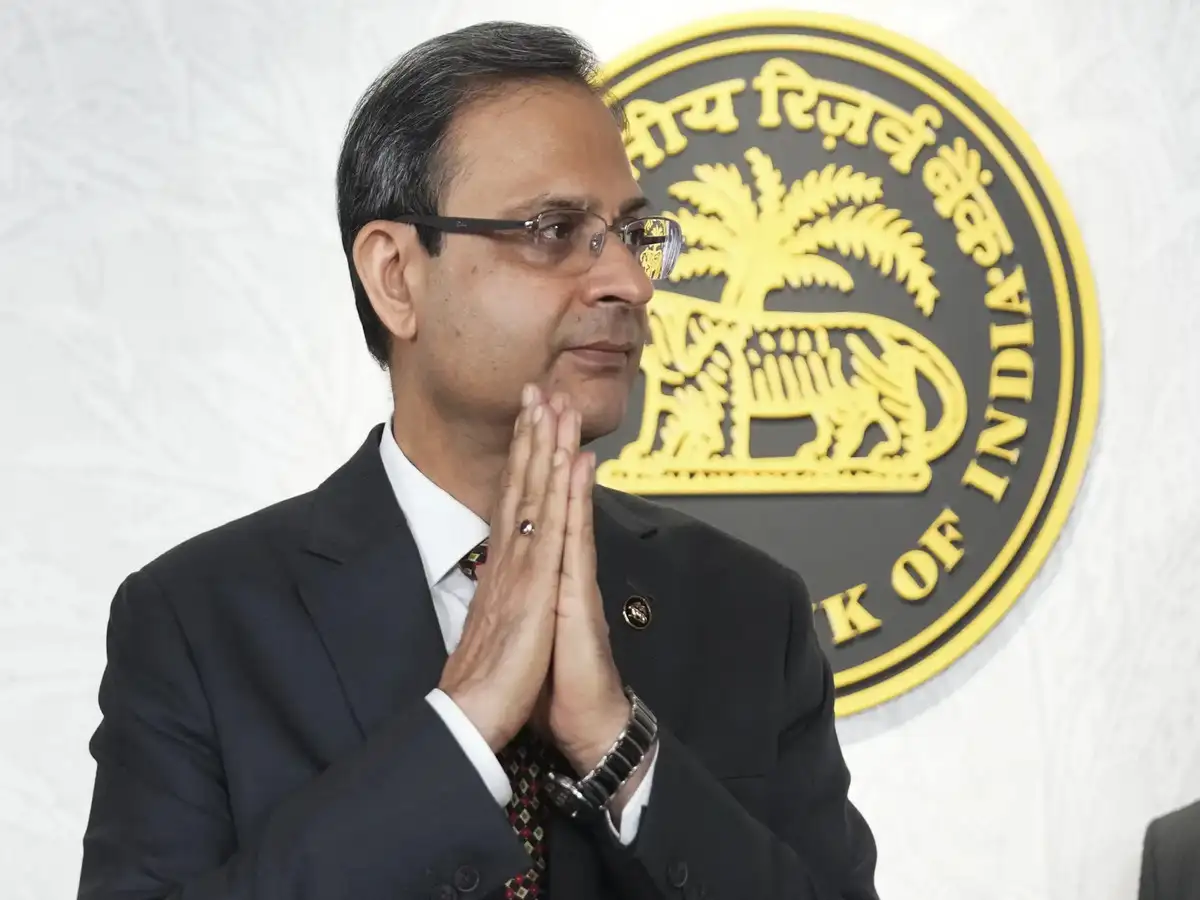

- Policy and Regulatory Signals: Local cues—from fiscal tweaks to RBI commentary—could steer investor outlook, especially if they align or conflict with global cues.

In smaller towns and emerging markets, where investor education levels vary, such volatility can be particularly unsettling. Residents following markets through local brokerages or regional news may feel abrupt swings more keenly, especially those with direct exposure to mutual funds or small-cap stocks.

In conclusion, today brings a mix of optimism, caution, and ambiguity—all at once. For traders and investors across India, especially beyond the metros, the key will be to stay alert, stay informed, and avoid being swept up in reactions that miss the bigger picture.