Now Reading: RBI cuts policy rates again as inflation stays within comfort zone

-

01

RBI cuts policy rates again as inflation stays within comfort zone

RBI cuts policy rates again as inflation stays within comfort zone

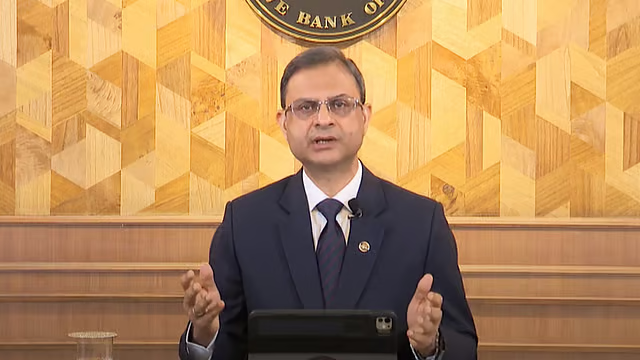

The Reserve Bank of India has cut policy rates again as inflation remains benign despite a recent rise in food prices. The move signals that the central bank sees enough stability in core inflation to support economic growth while managing short term price pressures.

The rate cut aligns with the RBI’s broader strategy of balancing growth and inflation expectations. While food prices have shown intermittent spikes, the central bank noted that overall inflation has stayed within its medium term range, supported by steady supply conditions and moderation in global commodity prices.

RBI policy decision and secondary inflation indicators behind the rate move

The RBI policy decision reflects a careful assessment of inflation indicators beyond volatile food categories. Core inflation, which excludes food and fuel, has remained soft for several months. This trend gives the central bank room to adjust policy rates without increasing the risk of pass through inflation. Monetary authorities emphasised that the economy continues to expand at a stable pace, supported by consumption, investment and resilient services activity.

Secondary inflation indicators such as fuel prices, transport costs and manufactured goods have shown limited upward pressure. Global demand softness has kept import prices steady, further reducing inflation risk for India. This allowed the monetary policy committee to vote in favour of a rate cut that aims to ease borrowing conditions for businesses and households.

Impact of food price rise and secondary supply chain dynamics

Although food prices recorded a rise in recent weeks, the increase was concentrated in vegetables and specific perishables. Supply chain dynamics suggest that seasonal fluctuations, weather related disruptions and uneven arrivals contributed to the short term spike. Policymakers believe these pressures will ease as new crop arrivals improve supply.

Historical data shows that food inflation volatility does not necessarily translate into sustained headline inflation unless supply shortages persist for multiple months. In this case, the central bank assessed that the rise was temporary and did not warrant tighter monetary conditions. Market analysts note that the RBI has become more tolerant of short lived food price swings as long as broader indicators remain stable.

Market reaction, lending rates and secondary financial sector implications

Markets reacted cautiously but positively to the rate cut, with bond yields edging lower and banking stocks seeing mild gains. A reduction in policy rates typically leads to lower lending rates over time, although transmission depends on liquidity conditions and bank level balance sheet factors. Secondary implications for the financial sector include increased loan demand across retail and corporate portfolios.

Banks may see improved activity in home loans, auto loans and small business credit. The manufacturing sector, which has shown consistent recovery, is expected to benefit from lower borrowing costs. Investors are also evaluating how the rate cut interacts with fiscal measures scheduled for the coming quarters. Market participants believe that stable inflation gives policymakers flexibility to support growth without compromising macroeconomic discipline.

Medium term outlook, growth dynamics and secondary risks to monitor

The medium term outlook remains constructive, supported by steady growth projections, strong urban consumption and expanding capital expenditure. The central bank expects the economy to maintain momentum even as global conditions remain uncertain. Secondary risks include geopolitical tensions, global commodity volatility and unexpected supply disruptions in food markets.

RBI officials highlighted that future policy adjustments will depend on inflation behaviour, monsoon patterns and global financial market trends. They noted that while inflation is currently benign, sustained vigilance is necessary. If food prices surge again due to climate variability or distribution bottlenecks, the central bank may recalibrate its stance.

For now, the policy environment remains accommodative. Economists expect loan demand to strengthen further and corporate investment cycles to gain traction. The RBI is likely to maintain a supportive approach as long as inflation stays aligned with its target band and external risks do not escalate sharply.

Takeaways

RBI cut policy rates again as headline inflation stayed within its comfort zone

Food price increases were considered temporary and not a threat to core inflation

Lower rates are expected to support credit growth and business recovery

Medium term stability depends on global conditions and domestic supply trends

FAQs

Why did the RBI cut rates despite rising food prices

The central bank assessed that the food price rise was temporary and that core inflation remained stable, allowing space for easing.

How will the rate cut affect borrowers

Borrowing costs may decline gradually as banks transmit the policy cut, improving affordability for home, auto and business loans.

Does the rate cut signal long term easing

Not necessarily. Future decisions will depend on inflation data, global conditions and domestic supply factors.

Will rising food prices become a bigger concern

Only if the increase becomes prolonged. Current assessments show the rise is seasonal and likely to moderate.