Now Reading: RBI Maintains Repo Rate at 5.5%, Projects 6.8% GDP Growth Amid Global Uncertainties

-

01

RBI Maintains Repo Rate at 5.5%, Projects 6.8% GDP Growth Amid Global Uncertainties

RBI Maintains Repo Rate at 5.5%, Projects 6.8% GDP Growth Amid Global Uncertainties

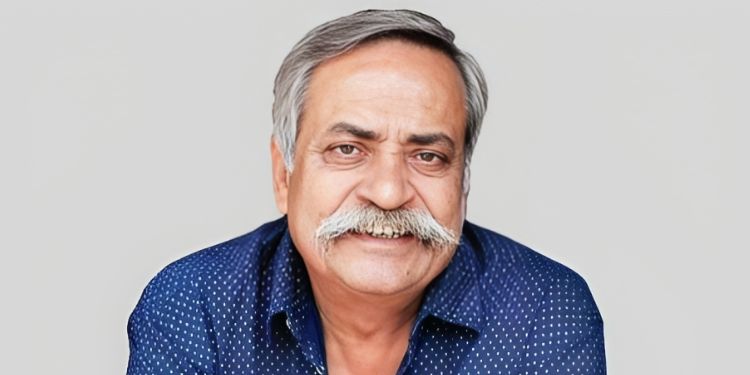

In its October 2025 Monetary Policy Committee (MPC) meeting, the Reserve Bank of India (RBI) decided to keep the key repo rate unchanged at 5.5%. This move aligns with market expectations and follows a cumulative 100 basis points (bps) rate cut earlier in the year. RBI Governor Sanjay Malhotra emphasized a “wait and watch” approach, citing the need to assess the impact of previous policy measures amid ongoing global economic challenges.

Economic Growth Outlook

Despite global trade uncertainties, including U.S.-imposed tariffs on Indian exports, the RBI has revised its GDP growth forecast for the fiscal year 2025-26 to 6.8%, up from the previous projection of 6.5%. This adjustment reflects stronger-than-expected growth in the April-June quarter, which saw a 7.8% expansion. Governor Malhotra noted that the economy continues to show resilience, supported by robust government spending and rural demand.

Inflation and Monetary Policy Stance

The RBI has lowered its inflation forecast to 2.6%, citing lower food prices and recent tax cuts. Core inflation remains subdued at 4.2%, indicating that underlying price pressures are largely contained. In light of these developments, the MPC has retained its “neutral” policy stance, signaling a balanced approach to managing inflation and supporting economic growth.

Market Reactions

Following the RBI’s announcements, Indian financial markets exhibited positive reactions. The Sensex and Nifty indices saw gains, particularly in sectors sensitive to interest rates, such as banking and real estate. The Indian rupee strengthened against the U.S. dollar, and bond yields remained stable, reflecting investor confidence in the central bank’s policy direction.

Conclusion

The RBI’s decision to maintain the repo rate at 5.5% underscores its cautious approach amid global economic uncertainties. By revising its growth forecast upwards and lowering inflation projections, the central bank aims to support economic stability while remaining vigilant against potential risks. As the festive season approaches, the impact of these policy measures on consumer spending and investment will be closely monitored.