Now Reading: Reliance Pulls the Plug: ₹1,645 Crore Investment in Dunzo Written Off

-

01

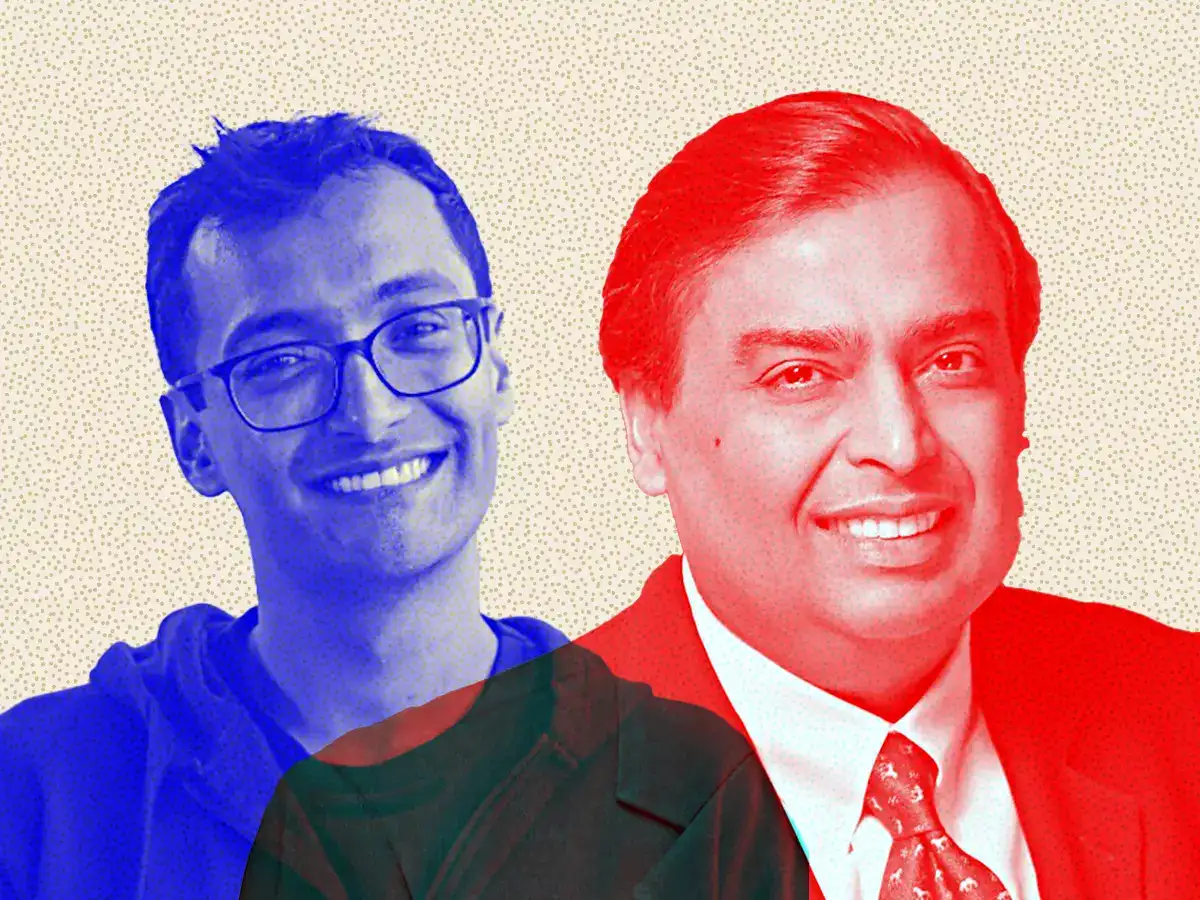

Reliance Pulls the Plug: ₹1,645 Crore Investment in Dunzo Written Off

Reliance Pulls the Plug: ₹1,645 Crore Investment in Dunzo Written Off

Reliance Industries has officially written off its substantial investment in Dunzo, marking an end to its financial commitment in the hyperlocal delivery startup. This move comes after years of cash burn, leadership exits, and intense competition in India’s cut‑throat quick‑commerce space. For businesses and on‑ground services in Tier 2 cities, the implications are profound—it’s not just a setback for Dunzo but a lesson in the limits of rapid-scale models.

From Growth Ambition to Write-Off

In early 2022, Reliance Retail led a $240 million funding round for Dunzo, securing around a 25–26 percent stake. The goal was expansion into quick commerce and boosting JioMart’s logistics. Three years on, Reliance has marked the entire stake—tallied at ₹1,645 crore—as a write-off, signaling that the expected returns never materialized due to operational challenges and financial pressures.

What Went Wrong: Accelerated Burn and Declining Performance

Dunzo’s aggressive push into 20-minute delivery services, high-cost marketing, and expansion efforts backfired. Monthly expenses soared, and multiple layoffs followed. Despite raising over $450 million, Dunzo struggled to build a sustainable business model. It remained heavily dependent on external funding, and when investors cooled off, the platform couldn’t survive—leading to its shutdown earlier this year.

Ripple Effects for Local Ecosystems

In smaller cities, many businesses relied on Dunzo-like services for deliveries and customer reach. With Dunzo gone, local shops may struggle to find reliable quick-commerce partners, affecting everything from grocery fulfilment to small vendor visibility. It also raises red flags for other quick-commerce players operating in less-established markets.

A Broader Perspective for India’s Startup Space

Dunzo’s fall and Reliance’s write-off underscore how even well-funded startups can fail without solid unit economics. As other investors consider entering the hyperlocal delivery space, the balance between scale and sustainability is now proving more crucial than ever.

Conclusion

Reliance’s decision to write off its Dunzo investment isn’t just a business move—it’s a signal that aggressive expansion must be underpinned by resilience and long-term thinking. For entrepreneurs, investors, and small businesses across India, especially in emerging towns, this moment marks a reboot in strategy: growth needs to be smart, not just fast.