Now Reading: Signals to Keep an Eye On: Tracking Crypto Trends in India

-

01

Signals to Keep an Eye On: Tracking Crypto Trends in India

Signals to Keep an Eye On: Tracking Crypto Trends in India

For Indian crypto traders, especially in Tier-2 cities, navigating the ups and downs of the market can feel overwhelming. Prices move fast, news spreads instantly, and hype often blurs judgment. To make better decisions, investors need to focus on key signals that shape the direction of digital assets. Watching these indicators closely can help cut through the noise and provide a clearer sense of where the market is heading.

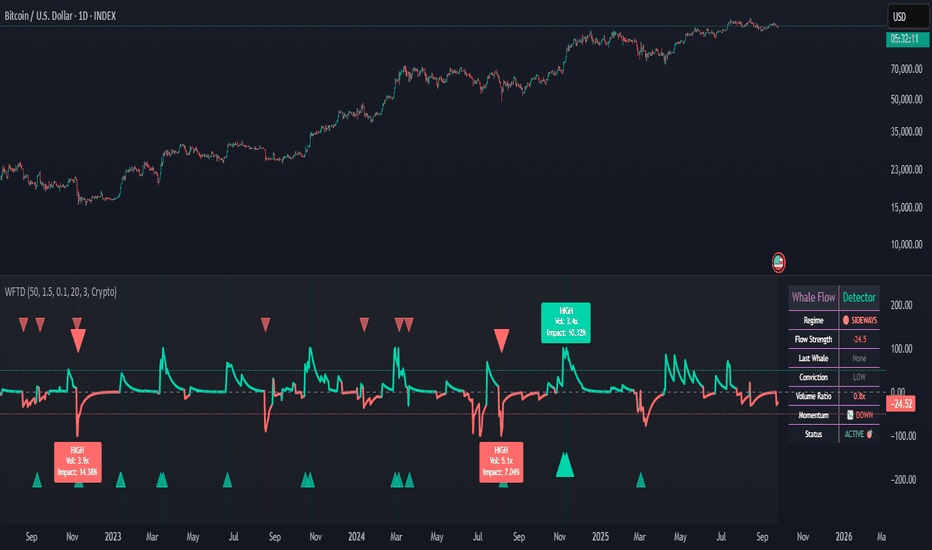

The first signal is institutional activity. When global funds and companies invest in crypto through regulated products like ETFs, it usually strengthens long-term confidence. Even though Indian traders may not directly access these products, their impact on global prices reflects locally and influences the mood of retail investors.

Another important signal is regulatory updates within India. Announcements on taxation, digital asset laws, or policies from the Reserve Bank of India often trigger sharp movements. For traders in cities like Nagpur, Jaipur, or Bhopal, keeping track of these updates is as important as tracking price charts.

Trading volumes also act as a reliable indicator. Rising activity on Indian exchanges usually shows growing retail interest, while sudden drops can point to declining confidence or fear in the market. This is particularly useful for smaller investors to judge whether a trend has real strength or is just short-lived hype.

Global events must not be ignored. News of hacks, scams, or technical failures on major platforms can cause rapid selloffs. Similarly, positive developments like new blockchain projects or international partnerships can fuel optimism. Even if these events happen outside India, their effects reach domestic traders almost immediately.

For small investors, especially those entering from Tier-2 cities, the takeaway is not to chase every signal but to observe them together. A single indicator may mislead, but when multiple signals align, they provide stronger guidance.

In conclusion, crypto remains unpredictable, but staying alert to institutional flows, regulations, trading volumes, and global events can help Indian traders build a more informed strategy. The key is awareness and patience—two habits that matter more than timing the market.