Now Reading: The Psychology of People Falling for Ponzi Schemes

-

01

The Psychology of People Falling for Ponzi Schemes

The Psychology of People Falling for Ponzi Schemes

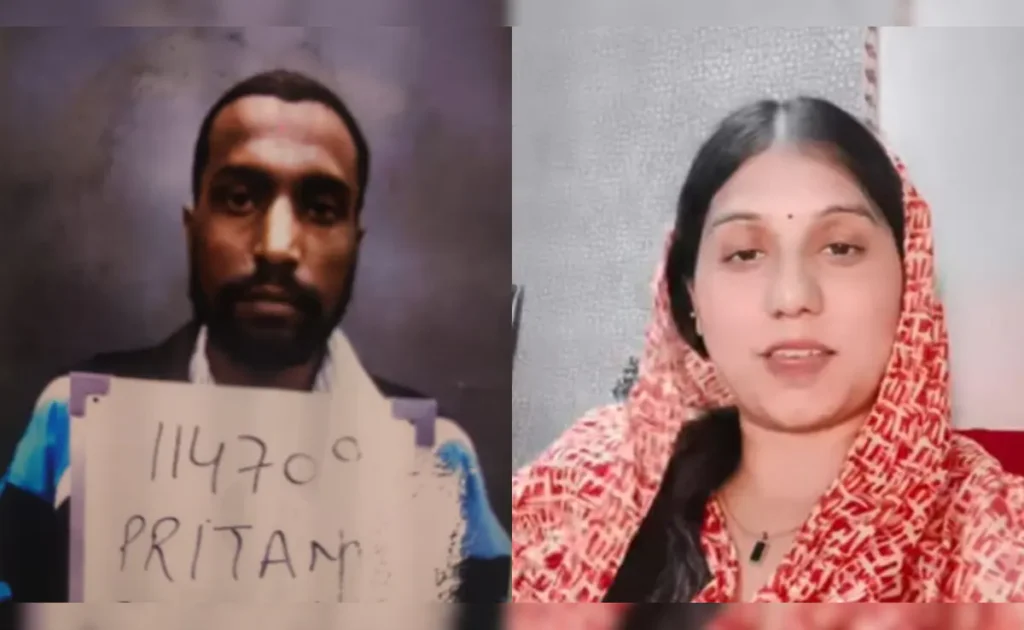

Ponzi schemes continue to lure investors across India, including in Tier 2 cities, despite widespread awareness of financial frauds. These schemes promise unusually high returns in a short period, appealing to the desire for quick wealth. Understanding the psychology behind why people fall for such schemes reveals how greed, trust, and social influence are exploited by fraudsters.

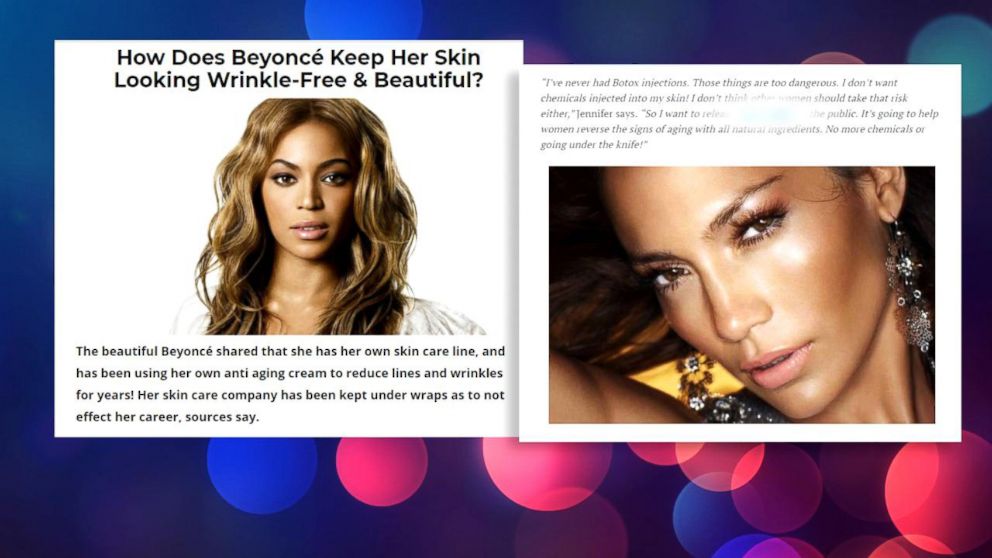

Ponzi schemes rely heavily on trust and social proof. Early investors often receive promised returns, creating a perception of legitimacy. Friends or family who participate and endorse the scheme increase credibility, making newcomers more likely to invest. The fear of missing out and the allure of easy money override rational decision-making.

Many victims underestimate the risks due to cognitive biases. People tend to believe in success stories, ignore warning signs, and assume that large-scale operations cannot be fraudulent. In Tier 2 cities, limited financial literacy and fewer opportunities for investment advice amplify susceptibility, making residents easier targets for scammers.

Preventing losses requires awareness and critical evaluation. Investors should question returns that appear too high, verify the source of profits, and avoid schemes that rely solely on recruiting new members. Seeking guidance from financial experts and relying on regulated investment platforms can reduce risk.

Ultimately, falling for Ponzi schemes is less about intelligence and more about psychology. Recognizing emotional triggers, social influence, and unrealistic promises can protect individuals from being manipulated into fraudulent investments.