Now Reading: Tokenisation of Financial Assets: The Next Step in India’s Digital Finance Journey

-

01

Tokenisation of Financial Assets: The Next Step in India’s Digital Finance Journey

Tokenisation of Financial Assets: The Next Step in India’s Digital Finance Journey

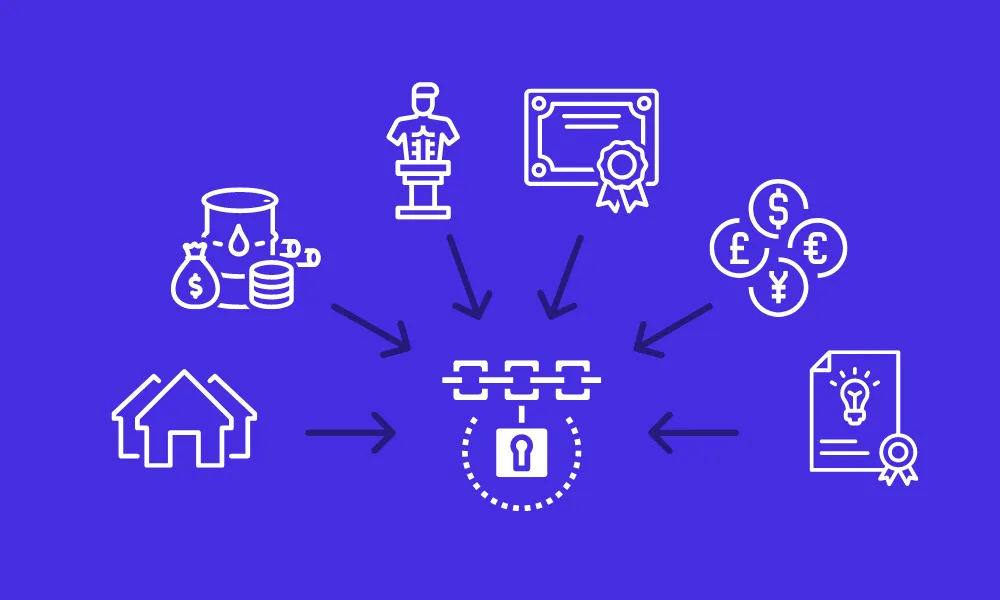

Imagine holding your fixed deposit, mutual fund, or even property as a digital token that can be traded or transferred instantly. That’s the concept of tokenisation—a process where real-world assets are converted into digital tokens on a secure blockchain. The Reserve Bank of India and financial institutions are now exploring how this technology could change the way Indians invest, borrow, and manage money, especially in smaller cities.

In simple terms, tokenisation breaks a financial asset into smaller digital units that represent ownership. These tokens can be traded or transferred just like shares, but with faster settlement and less paperwork. For example, a large fixed deposit could be divided into digital parts, allowing investors to sell a portion instead of breaking the entire deposit. For people in Tier-2 cities who prefer traditional savings but want flexibility, this could make finance more accessible and efficient.

The benefits extend beyond convenience. Tokenisation could allow local businesses to raise funds more easily by issuing digital tokens instead of relying on banks. It also makes investing more democratic—allowing small investors to buy fractional ownership in assets that were once reserved for high-net-worth individuals. This means someone in Nagpur or Surat could own a piece of a major infrastructure project or bond through a few clicks.

Banks and regulators are cautious but optimistic. The RBI’s recent pilot on tokenised certificates of deposit is an early sign of how mainstream this could become. If successful, tokenisation could reduce the layers of intermediaries in financial transactions, bringing down costs and settlement times. However, the system will need strong cybersecurity measures and clear rules to prevent misuse or fraud.

For investors, the biggest advantage could be liquidity. Traditional assets like fixed deposits or long-term bonds often lock money for years. Tokenisation could change that, allowing people to trade or pledge their tokens when they need quick cash. This flexibility could be especially valuable for small entrepreneurs and middle-class families who balance between saving and spending.

Still, the shift won’t happen overnight. Many Indians, particularly in smaller towns, still rely on physical documentation and in-person banking. Adopting blockchain-based systems will require awareness, trust, and digital literacy. Banks will also need to build user-friendly interfaces that make this technology simple for the average investor.

India’s journey toward digital finance has already seen success through UPI and digital wallets. Tokenisation might be the next big step—bringing transparency, speed, and flexibility to traditional financial products. If implemented carefully, it could transform the way Indians perceive savings and investments, turning everyday financial habits into part of the country’s digital revolution.