Now Reading: Why Mom-and-Pop Stores Can’t Yet Pass on GST Cuts: Costs, Stock, and Systems

-

01

Why Mom-and-Pop Stores Can’t Yet Pass on GST Cuts: Costs, Stock, and Systems

Why Mom-and-Pop Stores Can’t Yet Pass on GST Cuts: Costs, Stock, and Systems

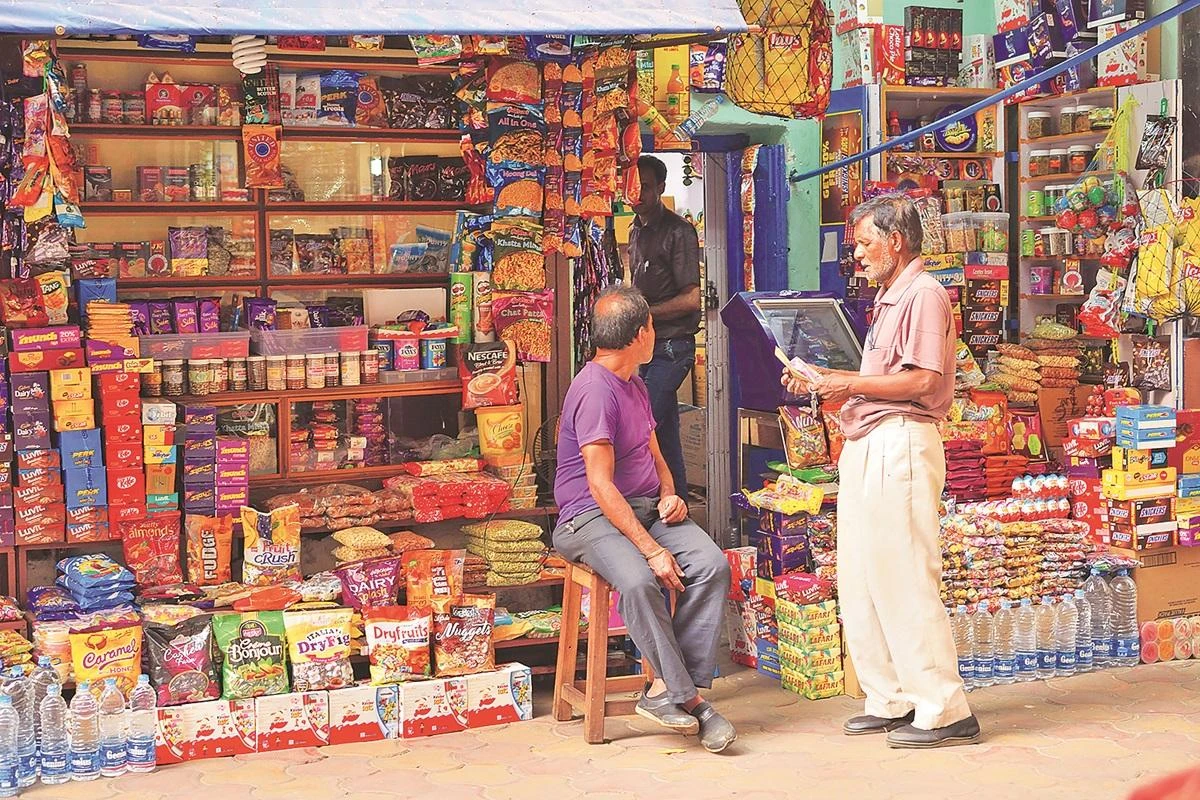

Many small retail shops across India are eager to pass on recent GST rate cuts to customers but struggle to do so immediately. Kirana stores, local pharmacies, and provision shops are facing delays because of old stock with high MRPs, manual billing systems, and slow delivery of updated pricing. This gap means the goods stay expensive longer in Tier-2 and Tier-3 towns even after tax reliefs are announced.

The biggest challenge is old stock with outdated MRPs. Many shopkeepers purchased goods before the new rates came into effect, and those packages still carry higher printed prices. Until this stock is sold, they are unable to legally reduce prices, leaving customers confused about why benefits are delayed.

Billing and technology add another hurdle. Small shops often depend on manual registers rather than digital billing software. Updating thousands of products to reflect new GST rates is time-consuming and prone to mistakes. For retailers in smaller towns with limited digital infrastructure, this task is even harder.

Delays from suppliers also play a role. Manufacturers and distributors need time to update packaging and labels with revised MRPs. New stock with adjusted pricing reaches metros first, while smaller towns receive it later, extending the lag before consumers notice changes.

Working capital constraints worsen the problem. If retailers reduce prices on old stock, they bear the loss until input credits or fresh supplies arrive. For mom-and-pop stores running on thin margins, absorbing that cost is rarely possible.

In Tier-2 and Tier-3 cities, these issues feel sharper. Supply chains are slower, digital adoption is limited, and customer expectations are high once announcements of tax reliefs are made. When local shops fail to reduce prices quickly, trust can weaken, even though the reasons are beyond their control.

Some shopkeepers are trying to bridge the gap by offering flat discounts, marking down only the new stock, or recalculating bills manually. But these stop-gap methods add complexity and sometimes reduce already thin margins.

A smoother transition would require clearer government guidance on handling old stock, faster digital adoption for billing, and quicker distributor response with updated price lists and supplies. Consumer awareness campaigns could also reduce friction by explaining why price changes take time.

GST rate cuts are designed to ease costs for the public, but their impact depends on how quickly shops can pass them on. For India’s small retailers, especially in semi-urban and rural areas, practical hurdles mean the benefit often takes weeks to show. Until supply chains, technology, and policy adjustments align, the relief will remain more of a promise than an immediate reality.