Now Reading: Why So Many People Still Fall for Stock Trading Scams

-

01

Why So Many People Still Fall for Stock Trading Scams

Why So Many People Still Fall for Stock Trading Scams

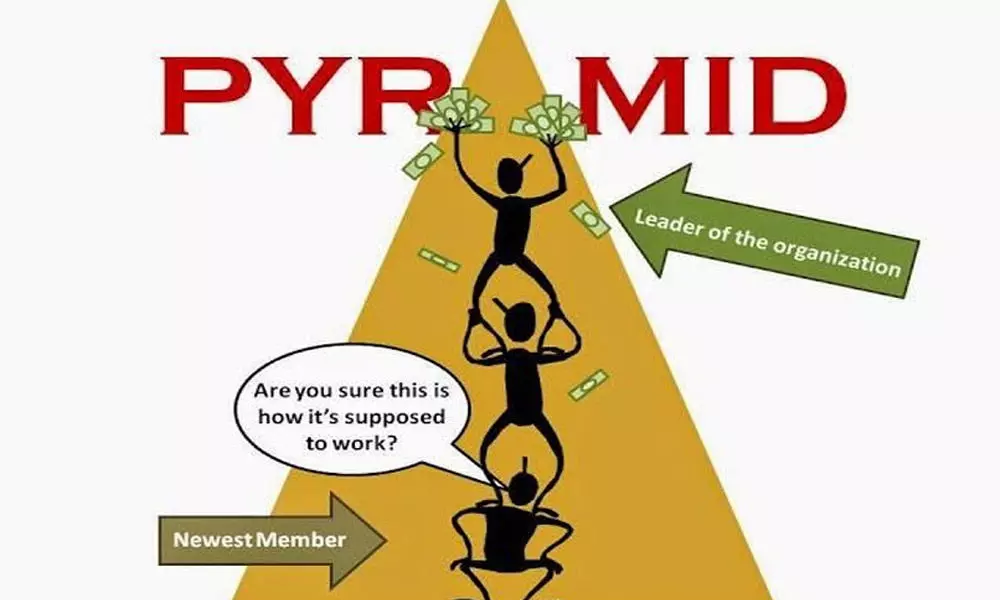

In recent years, India’s growing interest in stock trading has opened doors for both financial growth and financial fraud. Social media is filled with influencers promising quick profits, Telegram groups offering “sure-shot” tips, and fake brokers claiming guaranteed returns. Despite repeated warnings, thousands still fall for these traps every year. The question is — why do people keep believing in easy money?

The Psychology Behind Quick Gains

Human behavior plays a major role in the success of trading scams. Many people see stock trading as a shortcut to wealth. When influencers flaunt luxury cars or screenshots of massive profits, it triggers a sense of urgency and envy. People believe they’re missing out on something everyone else is profiting from. Scammers understand this emotion well — they promise speed, certainty, and minimal effort, all of which appeal to the human desire for instant rewards.

The Social Media Trap

Platforms like Instagram, YouTube, and Telegram have become hotspots for stock market misinformation. Fake traders build credibility by posting edited profit screenshots or fake testimonials. They often claim to have “exclusive” knowledge or insider tips that guarantee results. Many of these accounts vanish after collecting membership fees or investments. In Tier 1 and Tier 2 cities, young professionals and students looking for side income are the most frequent victims, lured by the dream of doubling money in weeks.

Lack of Financial Awareness

Financial literacy remains a serious gap in India’s trading culture. Many first-time investors start without understanding how the stock market actually works. They rely on influencers or self-proclaimed experts instead of verified sources. This lack of knowledge makes it easier for scammers to sound convincing. Terms like “options trading” or “intraday calls” are thrown around casually, making scams appear legitimate to those unfamiliar with real trading practices.

Fake Brokers and Online Manipulation

Another growing threat is the rise of unregistered brokerage platforms. These websites or apps mimic real trading platforms and ask users to deposit funds. Once the money is transferred, the scammers disappear. In some cases, fake customer support teams are used to delay withdrawals or extract more money. Victims usually realize the fraud too late, as transactions are often routed through offshore accounts or untraceable wallets.

Greed Meets Desperation

In an economy where inflation and job insecurity are growing, many Indians are looking for new income sources. Scammers exploit this desperation by presenting trading as a “risk-free” opportunity. Even educated investors can fall for these claims when emotions take over logic. The promise of fast returns clouds judgment, leading to impulsive decisions that end in losses.

How to Stay Protected

The best defense against trading scams is skepticism. Genuine stock trading involves research, patience, and risk — there are no shortcuts. Investors should always verify whether a broker is registered with SEBI and avoid anyone who guarantees profits. Social media “gurus” who sell courses or paid groups without transparent results should be treated with caution.

The Larger Lesson

Stock trading itself isn’t the problem — misinformation and manipulation are. As India’s financial markets expand and more people participate online, awareness becomes as important as opportunity. Understanding the basics of investing, verifying sources, and questioning unrealistic claims are small but powerful steps toward financial safety.

The truth is simple: in the world of trading, if something sounds too good to be true, it almost always is.